Annual Report 2024

ATG operates world-leading marketplaces and auction services for curated online auctions.

ATG seamlessly connects bidders from over 170 countries with 3,900 auction houses. In FY24 ATG helped facilitate the sale of 24 million curated used items, worth over $13bn, hosting in excess of 88,000 online auctions and promoting a channel of sustainable commerce.

Financial highlights

Revenue

Adjusted EBITDA

c

c

As with other two-sided marketplaces, augmenting revenue per transaction is especially important during periods when the underlying customer markets are challenging.”

ATG delivered another year of growth and continued to execute well against its strategic initiatives.”

Our six growth drivers provide multiple compounding levels for growth

Extend the total addressable market

Existing auction houses listing more assets as well as new auction houses listing assets on ATG marketplaces will extend our immediately addressable market. To extend beyond this, we can expand into new verticals and channels within the secondary goods market, as well as extending the scope of atgPay beyond an ATG marketplace.

Grow ATG's conversion rate

ATG’s conversion rate is a function of how often ATG provides the winning bidder. On the auctioneer side, we are actively facilitating the move from live to timed auctions. On the bidder side, we are enhancing the end-to-end user experience to drive bidder acquisition, engagement and conversion.

Enhance the network effect

By enabling auctioneers to cross-list on multiple ATG marketplaces and ATG white label solutions, auction houses can access an increased pool of bidders. Meanwhile, bidders can more easily browse a wider range of curated used items.

Grow take rate via value-added services

We are developing a wide suite of services that will both simplify auctioneer operations and also improve the user experience. Services include marketing, payments and shipping.

Expand operational leverage

ATG operates a hub and spoke model with centralised support functions. This allows us to drive profitability and generate cash as we grow, whilst also enabling our businesses to remain nimble and respond to local market conditions.

Pursue accretive M&A

We operate in a large and fragmented market, which provides inorganic growth opportunities. Our acquisition focus is on new verticals and/or geographies, and/or the addition of new value-added services and other products.

Our addressable market

We are committed to operating a responsible, sustainable business for the benefit of all our stakeholders.

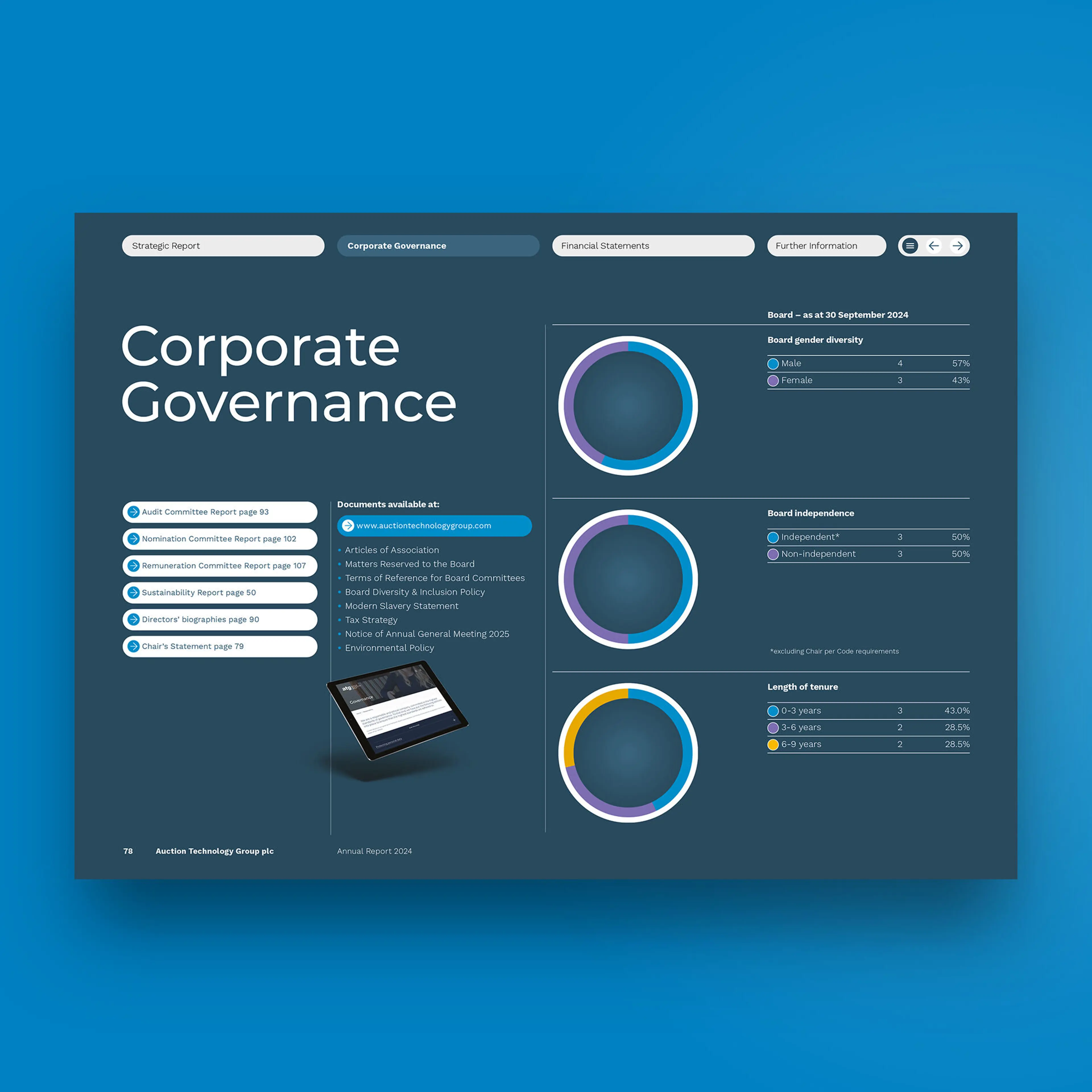

Committed to promoting the highest standards of corporate governance.

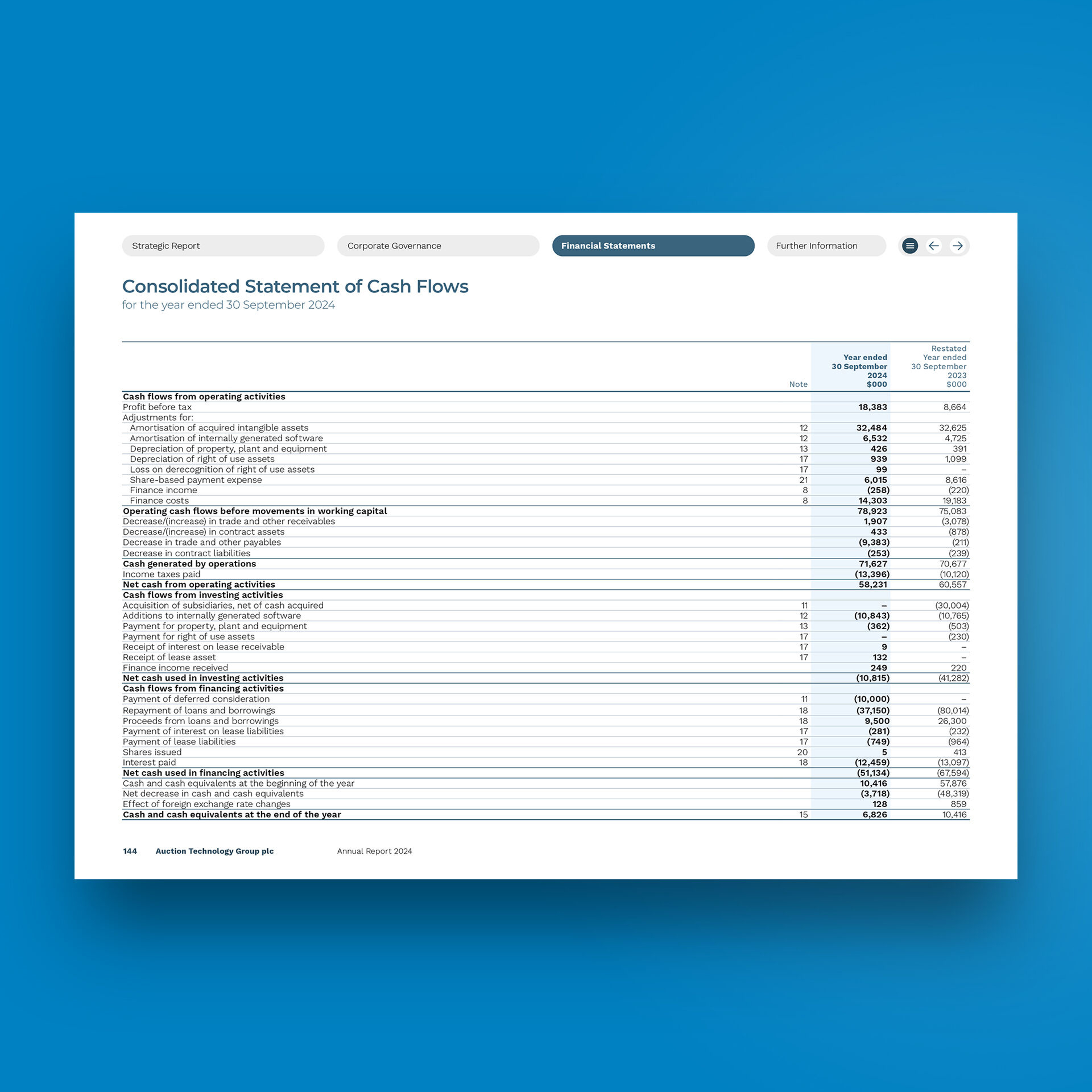

ATG has a diversified and resilient financial model, delivering robust growth in FY24.